- About CPDVRA

- Fee & Course Calender

- Download Brochure

- Why Choose CPDVRA

- Faculty

- Course Outline

- Career Opportunities

- Finance your Study

Certificate Program in

Derivatives Valuation & Risk Analytics (CPDVRA)

CPQFRM (Lateral Entry)

Build your career in Quants & Risk Management

- English

-

Indian Institute of Quantitative Finance

- Book a guidance call

Quick Facts

- Program Duration

- Program Schedule

- Program Timing

- Program Start Date

CPDVRA Program | Derivatives Valuation & Risk Analytics Course Highlights

- World Class Faculty: Learn from highly acclaimed Quant practitioners and Risk Management experts who have worked with topmost global investment banks and firms in New York, London, Singapore, Sydney and more, with academic background from some of the world’s top universities like Stanford (USA), Columbia (USA), IIM, IIT, ISI.

- Industry focused curriculum: Advanced curriculum designed by Quant and Risk Management practitioners from top Wall Street Investment Banks and financial institutions and industry experts to prepare job-ready professionals who are highly sought after by MNC financial institutions.

- Rigorous Practical Implementation: Strong emphasis on practical implementation and knowledge of the real-world application areas.

About the Course

Finance professionals as well as non-finance professionals (software developers, business analysts, credit analysts, etc.) who want to move into finance often want to learn to develop derivatives valuation and risk analysis models. Even experienced risk management professionals who have the theoretical background of the risk management models, find theirs skills to be inadequate when it comes to developing and practically implementing the models. For them having the theoretical background is not enough to actually implement these models in practice. Very often these models are now implemented in Python. This is why we have designed this course tailor-made for imparting these skills. This program is designed for people who have prior programming knowledge in any language and want to move into risk management or derivatives valuations field and want learn to develop applications related in these areas.

This is an implementation-oriented course in which practicing Risk Modellers, Investment Bankers and Treasury Professionals teach the latest valuation techniques and risk modeling skills that are used in the industry. This course starts with learning basic tools and theories related to the field and goes on to learning implementation of valuation models of derivative instruments of various asset classes using the models being used in the industry and then learning to carry out risk analysis and implement various risk models for various asset classes

| Batch | Start Date | Fee | Mode | Time |

|---|

Why choose CPDVRA® Program?

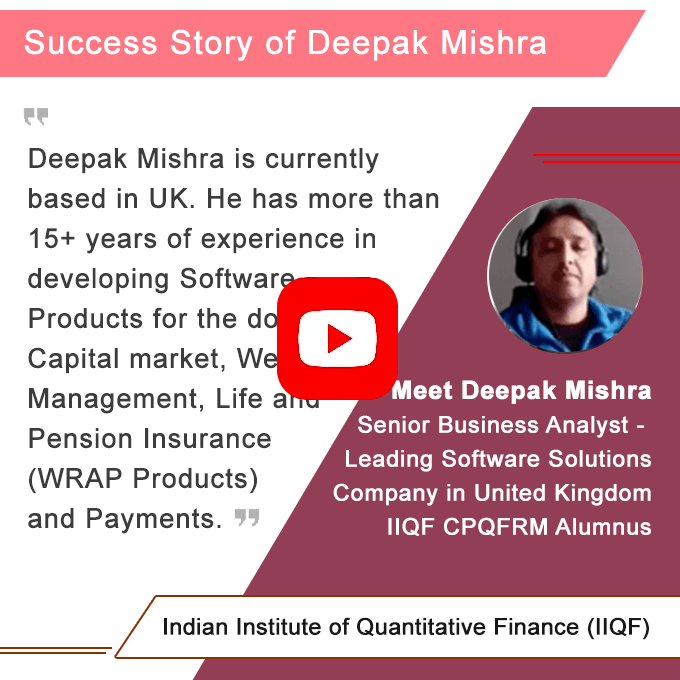

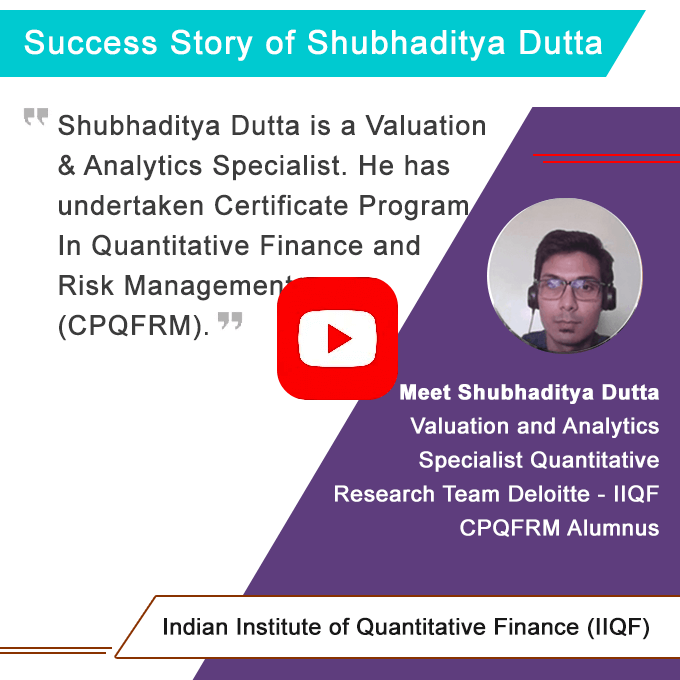

View what our learners have to say...

Abhijeet Vaze

"I had enrolled for the CPQFRM course at IIQF. It was six months of pure pleasure learning cutting edge, current market relevant Quant and Risk Management practises, philosophies and techniques. Brilliant team of lecturers coming straight from leading market entities in the Investment and Risk space. After completing this course I was able to successfully realise my desire to effect a career change towards Risk Analytics and Risk Modelling, after almost 13 years of experience. It has given me a successful start and also equipped me to consolidate my career as a result of hands on skills acquired. Not just CPQFRM but other courses also I would say are very apt and highly recommended!!"

Anand Kumar

"I had attended the Certificate Program in Derivative Valuations and Risk Analytics (CPQFRM Lateral Entry) using MS Excel and VBA Programming for Finance by Indian Institute of Quantitative Finance. I would highly recommend for professionals in finance, risk and statistics. I have gained immensely from the program specially from Credit and Market Risk, got a job in Credit Risk Modeling profile in Mumbai due to this course and would like to thank IIQF for the same. Special Thanks to "Abhijit Biswas" he was excellent, dedicated and very Knowledgeable. I wish them success in all their future programs."

Shubhaditya Dutta

"I had attended the Certificate Program in Derivative Valuations and Risk Analytics (CPQFRM Lateral Entry) conducted by Indian Institute of Quantitative Finance. I was previously working with a Registered Investment Advisory (proprietary firm) as a Quantitative Analyst. This program is very relevant for risk professionals with a specialization in OTC valuations. The content of the course is very practical for various asset class derivative valuation models and the codes and resources of the model can be utilized to build a foundation for Derivative Valuation Modelling. Lectures are very interactive with its content being useful for python modelling from scratch and prepare for Valuation and Model Validation quant roles... "

Shyam Nayma

"I had attended the Program in Derivative Valuations and Risk Analytics (CPQFRM Lateral Entry) conducted by Indian Institute of Quantitative Finance. Before joining I was working with one the broking firm for a long time and was looking for change the field. IIQF's relevant & up to date program helped me a lot in sharpening my skills and getting desired profile at NOMURA. I would highly recommend this program for its content, which is very relevant for professionals in finance & risk. Additionally Nitish Mukherjee from IIQF has put in lots of efforts to share & recommend my profile to various organizations and finally I got opportunity to work with Nomura, where also my profile was considered after Nitish's personal recommendation."

Nimisha Sharma

First of all I would like to thank you for providing me a chance of being part of Derivatives Valuation and Risk Analytics (CPQFRM Lateral Entry) program offered my IIQF .It is indeed incredibly informative and value added program for people like us, who are aspiring to make career in the field of risk analytic's and Quantitative Modelling .The personal guidance given by Abhijit Sir and other faculty members are rarely found and was extremely helpful.

Godliving Maro (CPQFRM participant)

"The course was excellent, I would peenally continue selling it in Tanzania."

Faculty

Ritesh Chandra

CFA, MBA from IIM Calcutta and B Tech from IIT Kanpur. He has more than 14 years of experience in Credit Risk, Corporate Finance & Technology and has worked in India, China & Canada in a variety of roles. He is currently working as a Group Executive Vice President - Corporate Banking Risk in a large private sector bank in New Delhi. Earlier he worked with Barclays Bank as AVP – Wholesale Banking Risk Analyst for an INR 20bn portfolio covering Working Capital facilities, Term loans / ECB, Trade Finance and Derivative products.

Srijoy Das

MSc. Finance from London Business School, B-Tech from IIT Kanpur. He has more than 15 years of experience in Quantitative analysis and research that includes areas such as Derivatives Pricing, Market and Credit risk and has worked in India, USA & UK in a variety of roles in international banks and consulting firms. His more recent projects over the last 4 years include model risk assessment of counter-party risk models and regulatory stress testing (CCAR, EBA) models for leading investment banks. Further he is a thought leader and a scholar who likes to connect with, influence and inspire his audience through writing, speaking, lecturing and debating and using a world class network of resources that include theories, best practices and subject matter experts..

Rupal

B.Tech from IIT, Kanpur and Executive MBA from IIM Kozhikode. Rupal has a vast experience of more than 12 years in various areas of finance. He currently works as Vice President, Fixed Income at one of the largest International Bank for their Corporate Investment Banking Division. Prior to this he was working as Assistant Vice President at Credit Suisse, Investment Banking Division. He has also been a regular internal trainer in the organizations that he has worked in.

Ujwal Dinesh

MBA from IIM-Calcutta, FRM, CFA, BE (NIT Surat), PG Diploma in Securities Law. He is currently working as a GM of one of the top MNC IT Company leading their Risk Management team and Derivative Valuations team. Earlier he was working with one of the top four Wall Street Investment Banks as Credit Analyst where he is responsible for structuring and recommending exposure for fund-based, non fund-based and derivative facilities. He has experience of statistical modelling of short-term interest rates in India. He has been a visiting faculty at leading business schools.

Edelbert D'Costa

Edelbert brings over 19 years of experience in banking, asset management and capital markets. He has been a part of the founding team of Yes Asset Management. Some of his earlier assignments have been with ING, Pramerica (Prudential of U.S.A.) and ICICI. He was entrusted the responsibility of starting the Investment Risk function at ING Investments India where he designed and built a formidable system to track and monitor key investment risk parameters thereby making sure that investment managers don't deviate from their scheme objectives. On the back of this achievement, his involvement was sought in projects at the Asia-Pacific level. He has been a member of various investment committees, valuation committees, risk committees and product committees where his inputs were sought in the areas of financial derivatives, investments and risk management. Prior to joining ING, he set up the derivatives and alternate research desk at Ambit Capital, the broking arm of the Ambit group, a leading boutique investment house. Here he crafted successful strategies involving exchange traded futures and options.

Keshav Jain

Keshav has done his Btech from IIT Kharagpur. He has also done his CFA and FRM. He currently works as an AVP in a top International Bank. He has worked across various investment banks and financial institutions in the areas of financial modelling, M&A, risk management, risk advisory, derivatives research and financial analysis.

*The faculty listed is indicative only. Instructors may be drawn from our broader teaching pool, and we reserve the right to include faculty members beyond the current pool as required.

What You Study

Participants will learn :

- Machine Learning for Finance and its implementation in Python

- Comprehensive theoretical background and Practical implementation of Derivatives Pricing Models in Python

- Comprehensive theoretical understanding of risk management concepts, from basics to advanced

- Practical Implementation for various Risk Models for Market Risk, Credit Risk, Operational Risk, Liquidity Risk etc. in Excel and Python

- Practical Implementation of latest Basel Norms/Dodd-Frank/FRTB etc.

Who Should Attend

- Financial Analysts

- Research Analysts

- Risk Analysts

- Credit Analysts

- Investment Managers

- Finance Controllers

- Subject Matter Experts

- Managers from corporates

- Management students

- IT Professionals

Brief Course Outline

-

Primer 1Introduction to Programming (Optional)

- Programming in Python

-

Module 204Machine Learning for Quantitative Finance (Compulsory)

- Introduction to Machine Learning

- Supervised Learning

- Regression Models

- Time Series Models

- Volatility Forecasting

- Unsupervised Learning

-

Module 205Stochastic Processes (Compulsory)

- Basic Stochastic Processes

-

Module 206Numerical Methods(Compulsory)

- Monte Carlo Simulation

-

Module 207Derivatives Valuations (Compulsory)

- Implementing Equity Options Pricing

- Implementing Currency Derivatives Pricing

- Implementing Interest Rate Derivatives Pricing

-

Module 208Risk Analytics 1 (Compulsory)

- Introduction to Financial Risk Management

- Market Risk Management

- Credit Risk Management

-

Module 209Risk Analytics 2 (Compulsory)

- Operational Risk Management

- Liquidity Risk Management

- Investment Portfolio Management

Placement

Students successfully completing the course will get placement assistance subject to fulfilment of applicable conditions.

Admission Process

-

Send Your Application

-

Get on a call with a counsellor

-

Wait for Application Acceptance

-

Pay the fee & join the upcoming batch

Finance your Study

Educational Loans

We are very happy to help you progress to greater heights in your career in every way possible. Education loans available at 0% interest for full time Indian residents. Easy EMI plans available.

Student Aid

Encourages the full time students to enter this domain, benefits, if you are still pursuing formal education.

Similar Courses

NEED HELP?

You can call us on +91-8976993621 or email us your contact details if you would like a call back

(This service is normally available between 9.00 AM and 9.00 PM all the day. At all other times, please submit an email request.)